Living in the digital era,

you can now manage your money easily and safely with

the Bank of China (BOC) Mobile Banking App at any time and anywhere.

Getting started

Begin your Mobile Banking journey in 4 easy steps!

Walk in to any of our branches

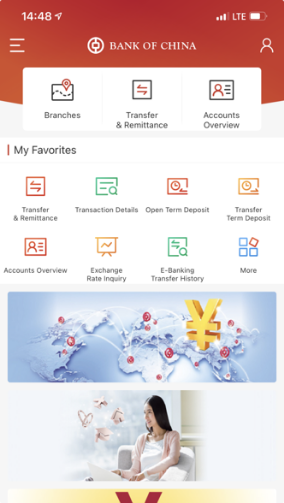

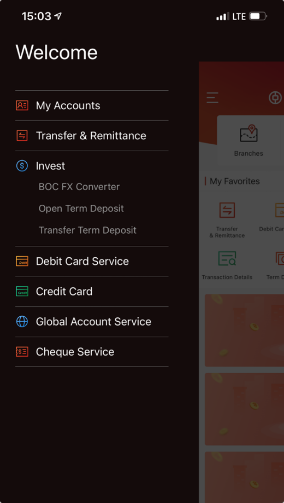

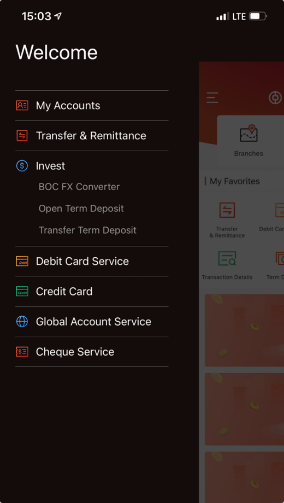

Customising Mobile Banking

Our Mobile Banking service offers you a number of unique personalised settings

to optimise your own financial experience.

Moving Money

Transfer money or send money via Mobile Banking in just a few taps, with lower charges and less time.

* Please note applicable currencies for remittances, as well as relevant regulations governing foreign exchange.

The Bank of China Global Payment of Intelligence (BOC-GPI) is applicable to certain overseas remittances fulfilling designated criteria. The GPI offers priority processing, tracking service and fee transparency. Please contact us for more details of GPI.

Managing Your Wealth

A few simple tips for you to better manage your wealth using the Mobile Banking service.

Connecting to the world

Using your Mobile Banking to serve your travel needs, invest overseas, and fulfill other aspirations.

Exchange foreign currencies for your overseas trips any time

Diversifying your wealth with overseas remittances*

*Please note applicable currencies for remittances, as well as relevant regulations governing foreign exchange.

The Bank of China Global Payment of Intelligence (BOC-GPI) is applicable to certain overseas remittances meeting designated criteria. The GPI offers priority processing, tracking service and fees transparency. Please contact us for more details of GPI.

Tips for

Cyber Security

| 1 | Ensure to sign off each time after use. |

| 2 | Change your Mobile Banking password regularly to keep your accounts secure. |

For security purposes, the Mobile Banking service will log off automatically after 5 minutes remaining idle. To continue using the service, simply log in again.

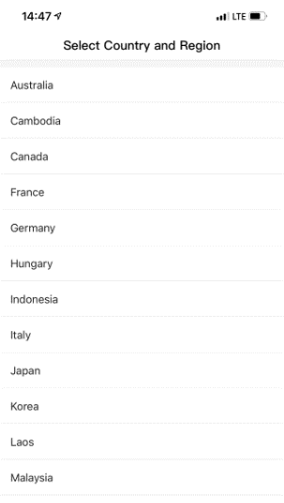

Step 3

Activate

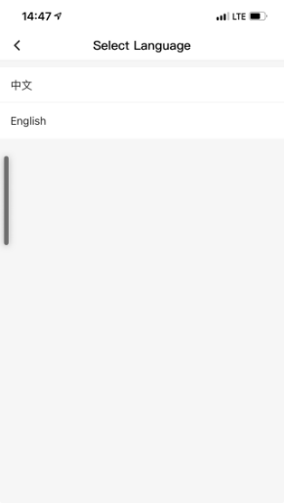

| 1 | Select your country or region |

| 2 | Choose your preferred language. You can change the language later if you want to. |

| 3 | Click the upper-right corner to log on |

| 4 | Enter your first-time user name and password provided in your secured slip |

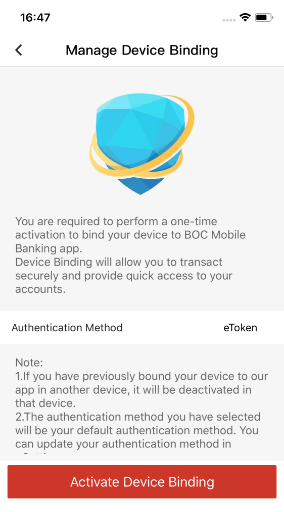

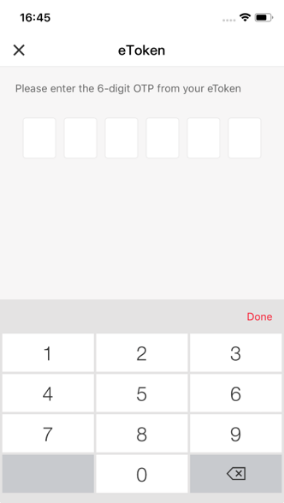

| 5 | A binding-your-device feature is built in to enhance security |

| 6 | Enter the passcode sent to you by SMS to your mobile phone, or the One Time Password from your e-token. |

Activation is done. For your financial security, please change your username and set up your own password as soon as possible.

Step 4

Encrypt

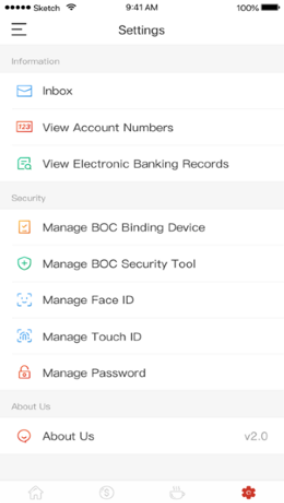

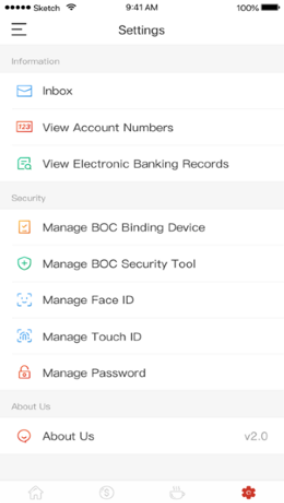

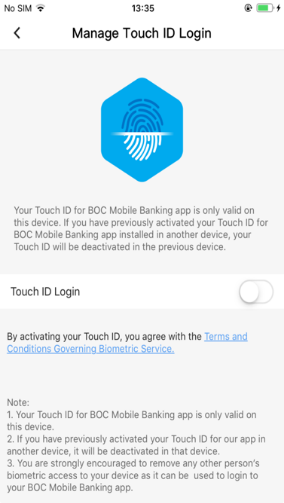

| 1 | Choose “Manage Touch ID” or “Manage Face ID” log on in the “Setting” menu |

| 2 | Choose “Manage Touch ID” or “Manage Face ID” log on in the “Setting” menu |

| 3 | Swipe right to activate the function |

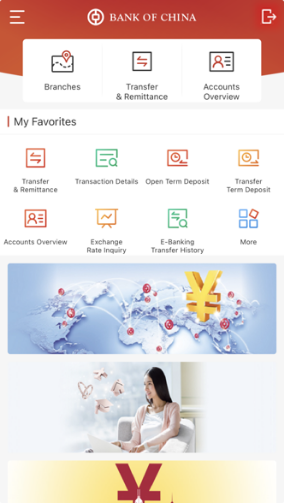

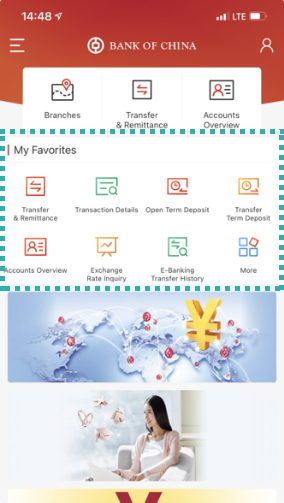

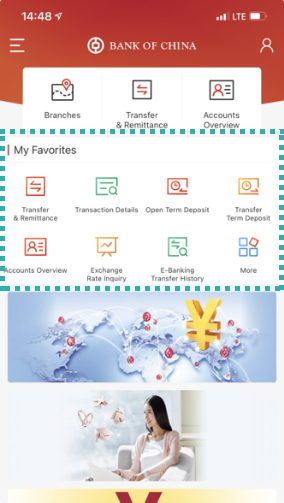

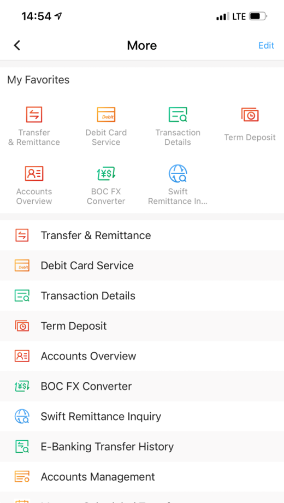

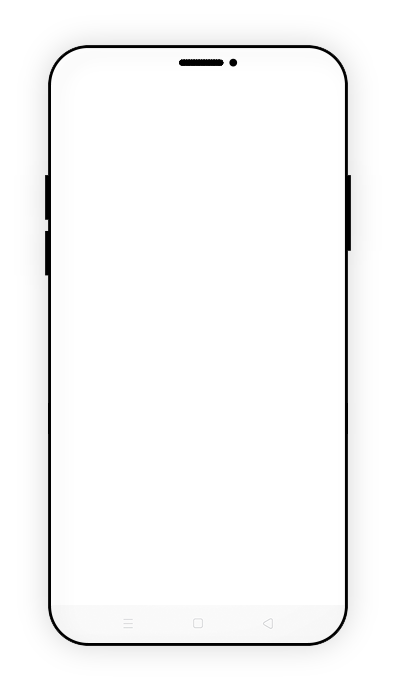

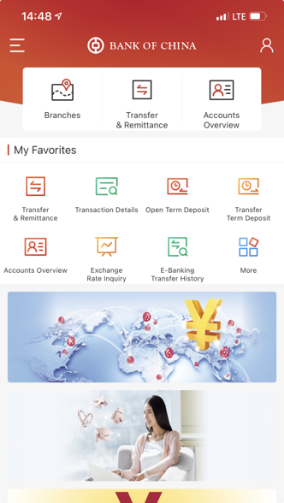

Customising Mobile Banking

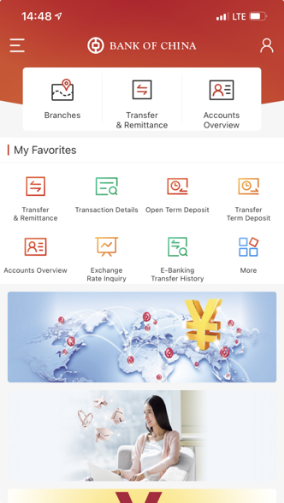

MORE CONVENIENT:

Customise your favourite functions

| 1 | You can choose up to seven functions and place them in the home page, to meet your daily financial needs. |

| 2 | Click ‘More’ to check other functions |

| 3 | Click ‘Edit’ in the top right corner to customise functions you use frequently. |

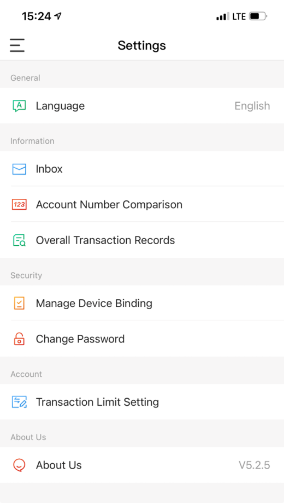

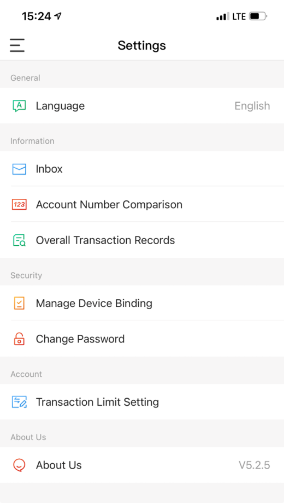

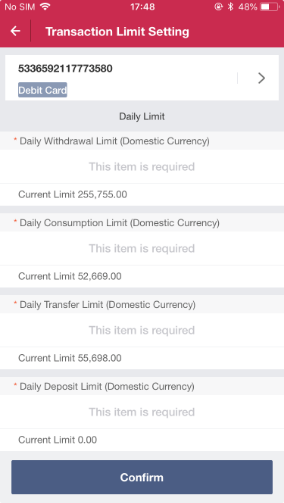

Customising Mobile Banking

MORE FLEXIBLE:

Change transaction limits at any time

| 1 | You can enter “Settings” page and click “Transaction Limit Setting” |

| 2 |

Set your daily cash withdrawal limit, consumption limit, fund transfer limit and deposit limit, and change them whenever you like.

These limits are subject to applicable caps.

|

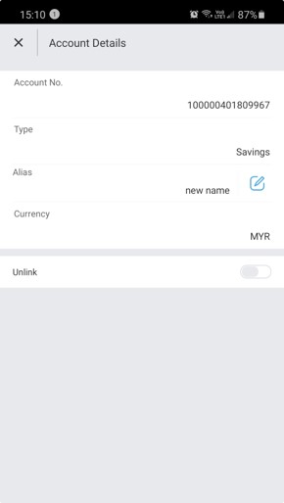

Customising Mobile Banking

MORE PRIVATE:

Show or hide your accounts

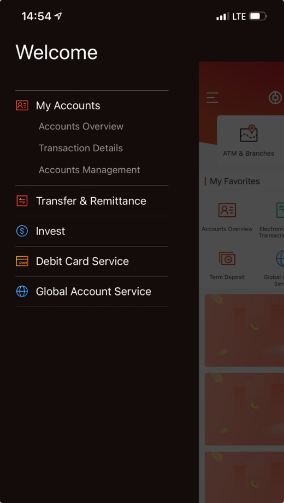

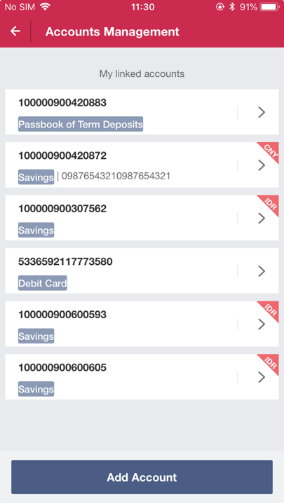

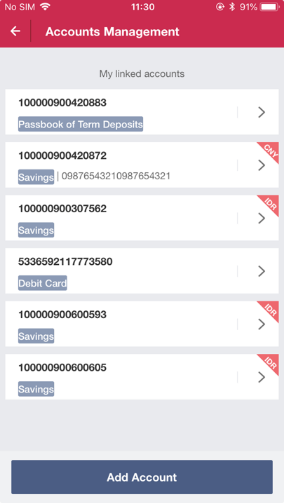

| 1 | Click the menu in the top left corner, select “Accounts Management” to add or delete accounts to be displayed in your Mobile Banking service |

| 2 | Add accounts to be displayed |

| 3 | Choose the account(s) that you would like to add |

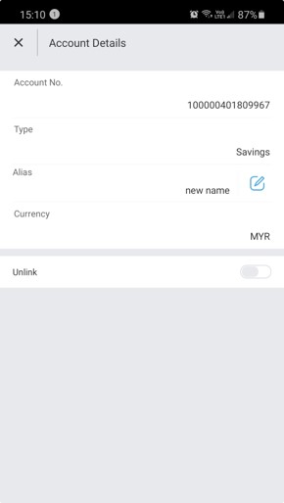

| 4 | Click to review the account(s) |

| 5 | Customise the name of your account(s) |

| 6 | Swipe right to delete account(s) which will not be displayed in your Mobile Banking |

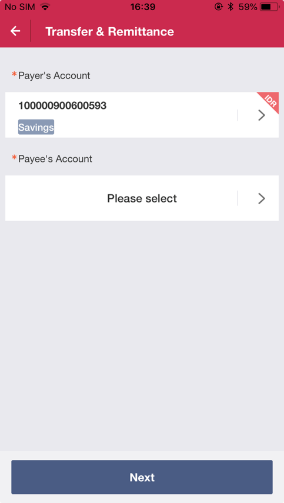

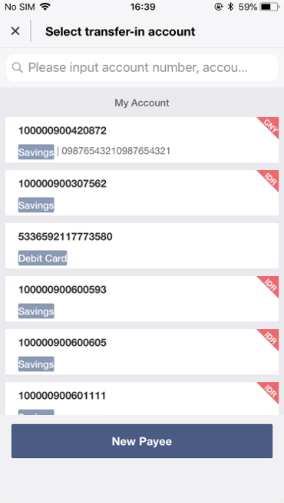

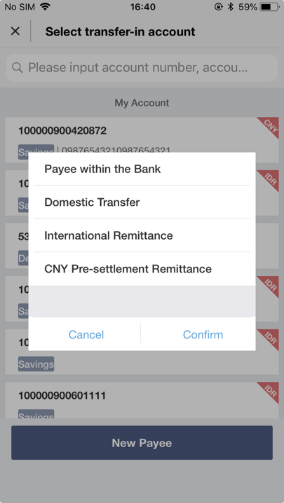

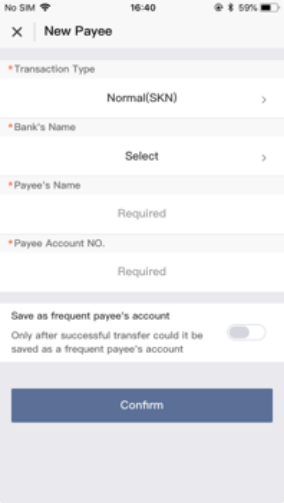

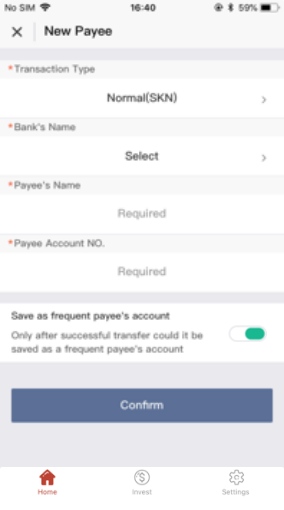

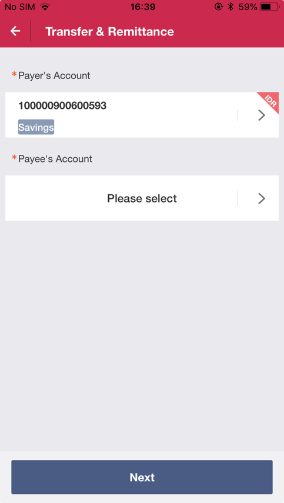

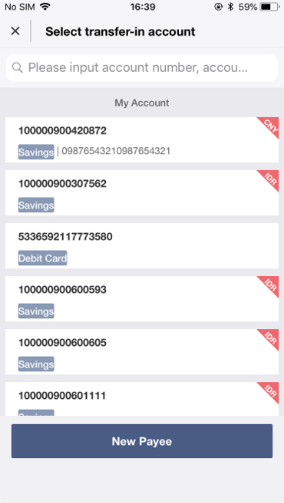

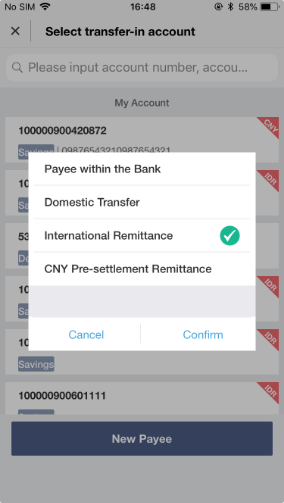

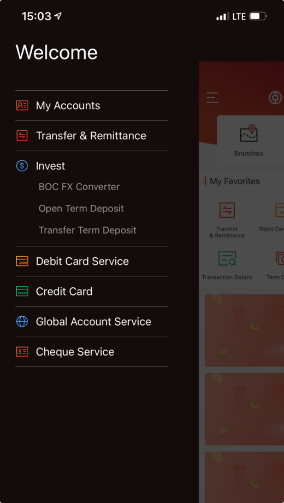

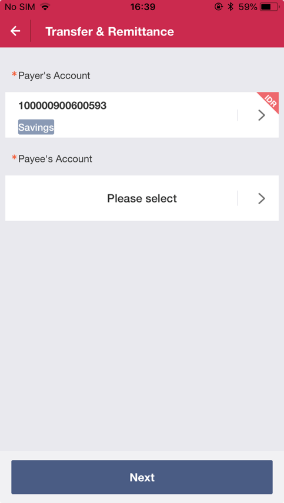

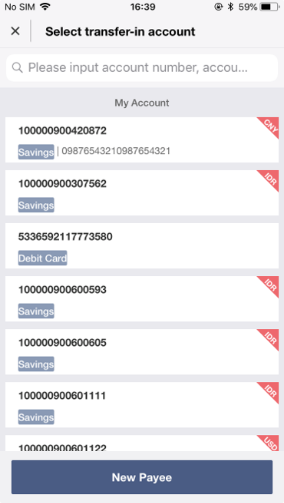

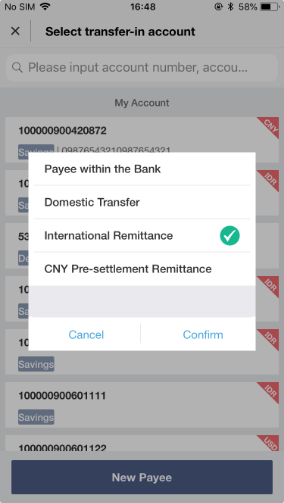

Moving Money

Fast Domestic Transfers

| 1 | Tap “Transfer & Remittance” |

| 2 | Select payer’s account and then select payee’s account |

| 3 | Tap “New Payee” |

| 4 | Select “Payee within the Bank” or “Domestic Transfer” |

| 5 | Enter the payee’s details, the transfer amount, and other necessary information. Click confirm and your transfers will be done swiftly. |

| 6 | Save the payee as a regular payee if needed |

Your transaction receipt can be saved or shared with payees.

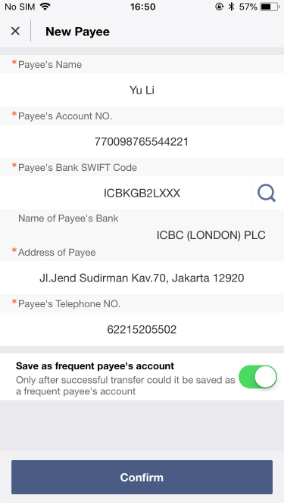

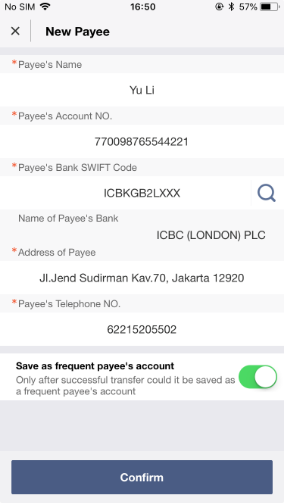

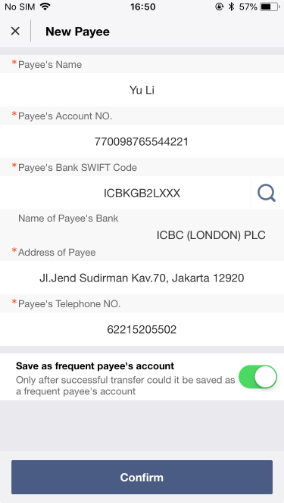

Moving Money

Convenient Overseas Remittances*

| 1 | Click “Transfer & Remittance” |

| 2 | Select payer’s account and then select payee’s account |

| 3 | Tap “New Payee” |

| 4 | Click “International Remittances”. |

| 5 | Enter the payee’s information, the remittence amount, etc. to complete the instruction. |

| 6 | Save the payee as a regular payee if needed |

The Bank of China Global Payment of Intelligence (BOC-GPI) is applicable to certain overseas remittances fulfilling designated criteria. The GPI offers priority processing, tracking service and fee transparency. Please contact us for more details of GPI.

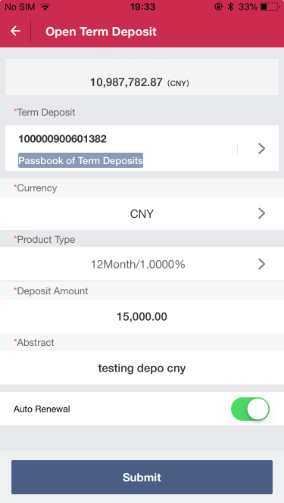

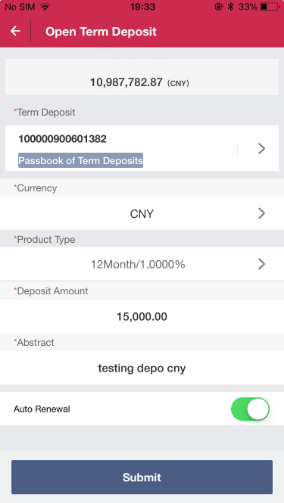

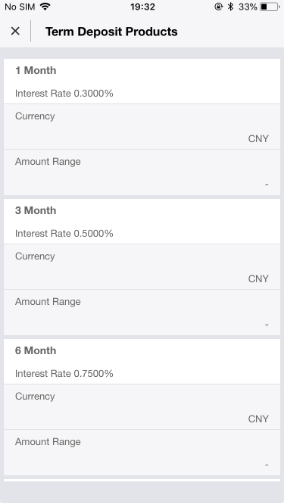

Managing Your Wealth

SAFE AND EASY Time Deposits

| 1 | Tap ‘Open Term Deposit’ |

| 2 | Choose your account |

| 3 | Select the appropriate term deposit products and enter the deposit amount |

| 3 | Select the appropriate term deposit products and enter the deposit amount |

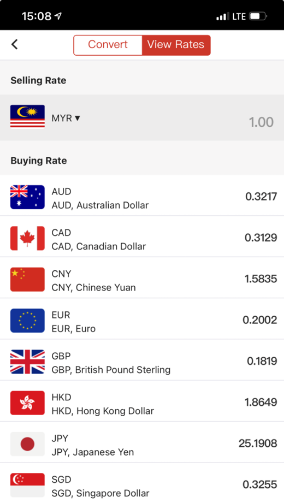

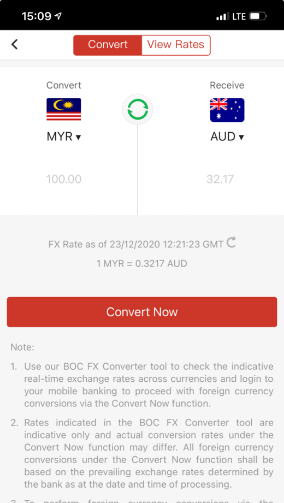

Managing Your Wealth

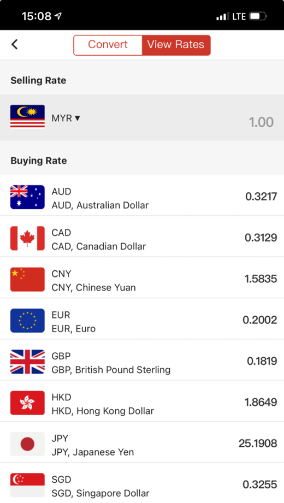

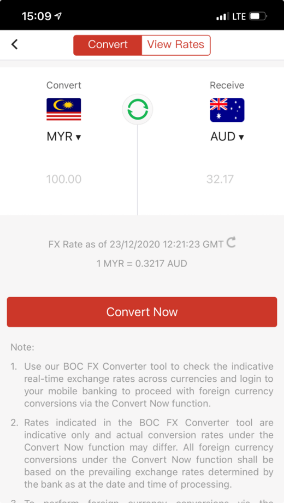

DIVERSIFYING WEALTH Foreign Exchange

| 1 | Tap ‘BOC FX Converter’ |

| 2 | View the current exchange rates |

| 3 | Select the currency you would like to buy, enter the amount, and tap ‘Convert Now’ |

Connecting to the world

Exchange foreign currencies for your overseas trips any time

| 1 | Tap ‘BOC FX Converter’ |

| 2 | View the current exchange rates |

| 3 | Select the currency you would like to buy, enter the amount and tap ‘Convert Now’ |

Connecting to the world

Diversifying your wealth with overseas remittances*

| 1 | Tap “Transfer & Remittance” |

| 2 | Select payer’s account and then select payee’s account |

| 3 | Tap “New Payee” |

| 4 | Select “International Remittance” |

| 5 | Enter the payee’s information, the remittence amount, etc. to complete the instruction |

| 6 | Select and save the payee as a regular payee if needed |

The Bank of China Global Payment of Intelligence (BOC-GPI) is applicable to certain overseas remittances meeting designated criteria. The GPI offers priority processing, tracking service and fees transparency. Please contact us for more details of GPI.